At two recent Andrews Partnership roundtables in Hong Kong and Singapore, heads of sustainability gathered to examine how ESG leadership is evolving. Against a backdrop of tightening regulations, political pushback and decreasing board enthusiasm, participants surfaced practical strategies that will shape hiring, governance and investment decisions.

The important distinction between ESG and sustainability

- Sustainability is the overarching goal, while ESG is the toolkit used to measure progress toward that goal.

- ESG criteria help companies quantify and report their sustainability efforts, making them accountable and transparent to investors and regulators.

- Together, they drive responsible corporate behaviour, enhance long-term profitability, and build resilience against environmental and social risks.

ESG at the board level: Hong Kong versus Singapore

A clear theme emerged from our discussions in both markets: successful ESG engagement requires translating sustainability initiatives into commercial language that resonates with board members.

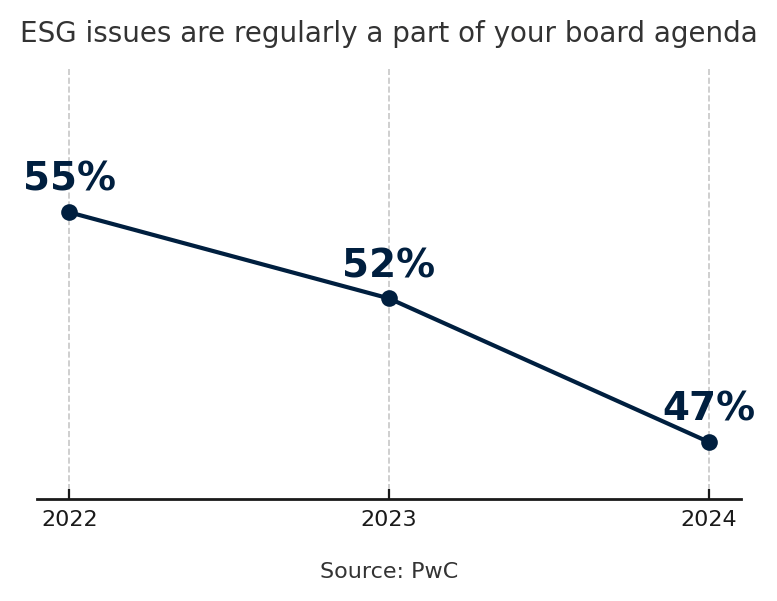

This challenge has become more urgent as a PwC report found that just 47% of boards now treat ESG as a regular agenda item, down from 52% in 2023 and 55% in 2022. The decline reflects growing board fatigue, a squeeze on agenda items amidst a growing list of priorities and a political headwind that fuels scepticism.

Whether through early strategic alignment or explicit value creation frameworks, leaders are finding that directors respond when ESG is framed in terms of material business impact rather than compliance metrics.

Hong Kong: Early engagement drives results

In Hong Kong, board awareness of ESG issues has improved markedly, with sustainability leaders finding success through engagement initiatives with directors to drive strategic alignment. Several Hong Kong-based sustainability leaders described a two-pronged approach: embedding ESG topics into executive committee materials and commissioning director-specific pre-briefings. As one participant explained, “We frame material risks in business-language scenarios rather than listing a string of metrics.” This approach ensures directors see a link to impact on profit and competitive positioning.

Trigger moments – such as the launch of the HKEX’s enhanced climate-disclosure requirements – have also provided valuable opportunities to convert board curiosity into formal commitments.

Singapore: Beyond compliance to value creation

By contrast, in Singapore, ESG can still feel like a reporting exercise unless explicitly linked to value creation. Several attendees lamented boardroom scepticism, noting that repetitive slide decks can dilute the urgency of ESG priorities.

“Sustainability has to be sustainable,” one Singapore leader reflected. “You can’t do good for the sake of good – it has to tie back to your business model.”

Echoing that sentiment, roundtable participants described how they have pivoted away from over-reliance on third-party ratings – sometimes criticised for producing “false positives” that distract from strategic debate – to bespoke internal dashboards that align ESG metrics with revenue or cost-saving targets.

Emerging trends in ESG leadership

Across both Hong Kong and Singapore, participants identified several critical themes reshaping how sustainability leaders operate, from strategic reframing to the evolution of internal structures and tools.

1. ESG reframed as strategy

The moral imperative behind sustainability has now merged with clear business drivers. Participants pointed to the sustained commitment to climate-target disclosures among large corporations as evidence of this shift, despite rising political pressures. These targets are increasingly tied to capital-allocation decisions, operational-efficiency programmes and new product innovations.

One Asia Pacific head of sustainability noted, “When you frame ESG investments as unlocking new revenue streams, boards suddenly become much more receptive.”

2. Board education and relevance

Plain English and storytelling have replaced jargon and dense tables. ESG leaders now describe their role as “translators,” converting evolving regulatory requirements into commercial-impact scenarios.

Participants shared examples of using customer journey narratives to illustrate social value programmes–for instance, demonstrating how worker-safety initiatives in manufacturing can reduce downtime and insurance costs. As one attendee put it, “You don’t win board engagement with jargon; you win it with relevance.”

3. Declining strategic use of ratings

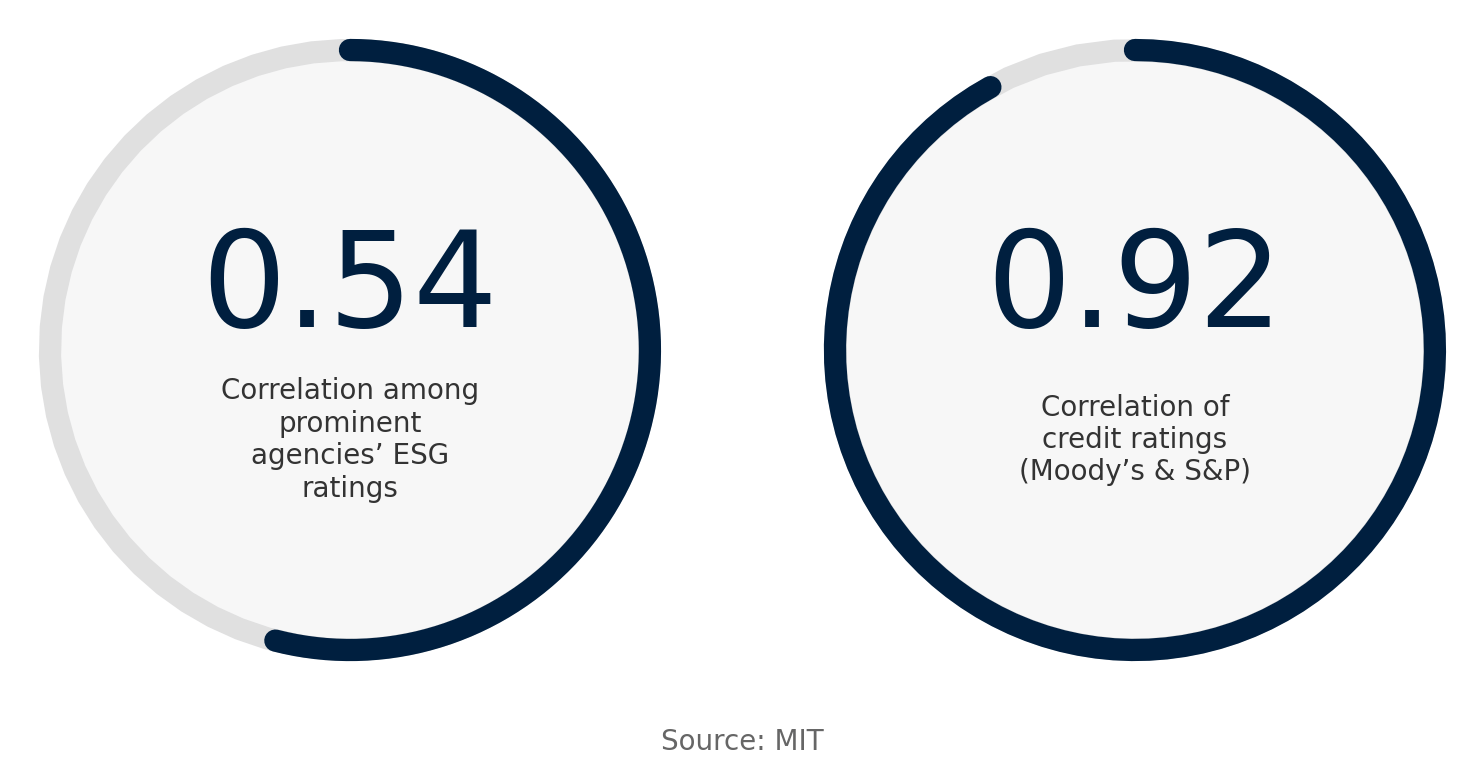

The credibility of ESG ratings has come under increasing scrutiny. A study from MIT highlighted significant divergence between ratings providers, with correlation levels of 0.54 far below the 0.92 of traditional credit scores.

At the roundtables, leaders argued that ratings still have a place in external reporting but are too blunt a tool for informing strategic decisions. Boards, they said, need bespoke insights into material risks and opportunities, not a single aggregate score.

4. Regulatory pressure driving action despite uncertainty

Participants noted a proliferation of overlapping disclosure regimes – from Singapore’s Monetary Authority and the HKEX to the EU’s Corporate Sustainability Reporting Directive – creating both impetus and confusion.

As one roundtable leader observed, “In Europe, banks are pulling back on climate directives, but in Asia, regulators are pushing harder.” Corporate teams are increasingly relying on legal and finance partners to map out compliance roadmaps and translate hard mandates into strategic priorities.

5. Internal tools and dashboards

With the growing gap between external disclosure and internal tracking, attendees described developing customised dashboards that integrate directly into board packs, delivering real-time insights on key performance indicators such as emissions intensity, diversity metrics and supply-chain risks.

These tools are credited with embedding ESG into ongoing governance, rather than treating it as an annual compliance exercise.

6. Social sustainability needs a business lens

Social metrics too often get relegated to corporate philanthropy unless reframed as either a licence-to-operate or a cost-efficiency lever. One leader explained how her team recast community-investment programmes around workforce retention and productivity gains, embedding them into broader operational scorecards.

Another noted that framing social initiatives in terms of supply-chain resilience unlocked fresh board interest and budget.

7. Hybrid ESG structures emerging

Across both markets, central ESG teams are giving way to distributed ownership models, with legal, finance and operations units stepping up as active partners. “The goal is to embed ESG across teams, but you need someone holding the thread or it gets lost,” said a Hong Kong participant.

This hybrid structure ensures that ESG is owned by the business rather than siloed, yet still benefits from strategic oversight.

Implications for future skills

As ESG shifts from a compliance function to a core business strategy, the skills leaders need are changing – and those who harness sustainability as a genuine growth driver will see their careers flourish. Roundtable attendees reflected on the implications for both hiring and career development across the region.

ESG roles are becoming strategists

The expectations for ESG professionals have broadened. No longer compliance-focused specialists, they must now speak the language of finance, risk management and operations. Hiring managers at the roundtables spoke of increasing demand for cross-functional talent capable of designing and leading enterprise-wide sustainability programmes.

Asia-specific regulatory literacy is key

Multinational firms, in particular, need regional experts with deep familiarity with local disclosure frameworks and geopolitical nuances. Singapore attendees emphasised that even minor variations in reporting requirements between the EU, Hong Kong and local MAS guidelines can have material budgeting and scheduling implications.

Sustainability talent moving into strategy

ESG expertise is fast becoming a direct pipeline into senior strategy roles. Employers are prioritising candidates who have designed measurable ESG interventions rather than those who have merely produced compliance reports. “If I had it my way, I’d work myself out of a job,” one leader admitted. “But we’re not there yet, especially in ops-heavy sectors.”

AP’s; 5 ways to make ESG a growth catalyst

In both Hong Kong and Singapore, boards are asking sharper questions and expecting clear connections between sustainability and business performance. It was clear from our discussions that leaders who hone their strategic and commercial skills to frame ESG in terms of profit impact, operational resilience and risk mitigation will win the most support.

Roundtable attendees offered these key pieces of advice to move sustainability from being seen as a compliance chore to a strategic driver:

- Speak the board’s language. Frame every ESG update around revenue growth, cost savings or risk reduction.

- Build simple, tailored metrics. Focus on a handful of key numbers tied to your company’s top priorities rather than a long checklist.

- Use trigger events. Link your ESG proposals to new regulations, market shifts or major projects to capture board attention.

- Equip your teams. Train finance, legal and operations colleagues to own ESG tasks so the effort doesn’t all rest on your shoulders.

- Tell a compelling story. Open each board paper with a one-sentence “so what?” that highlights the opportunity or threat.

By adopting these practical steps, sustainability leaders can ensure boardroom interest translates into real-world impact and lasting value creation.